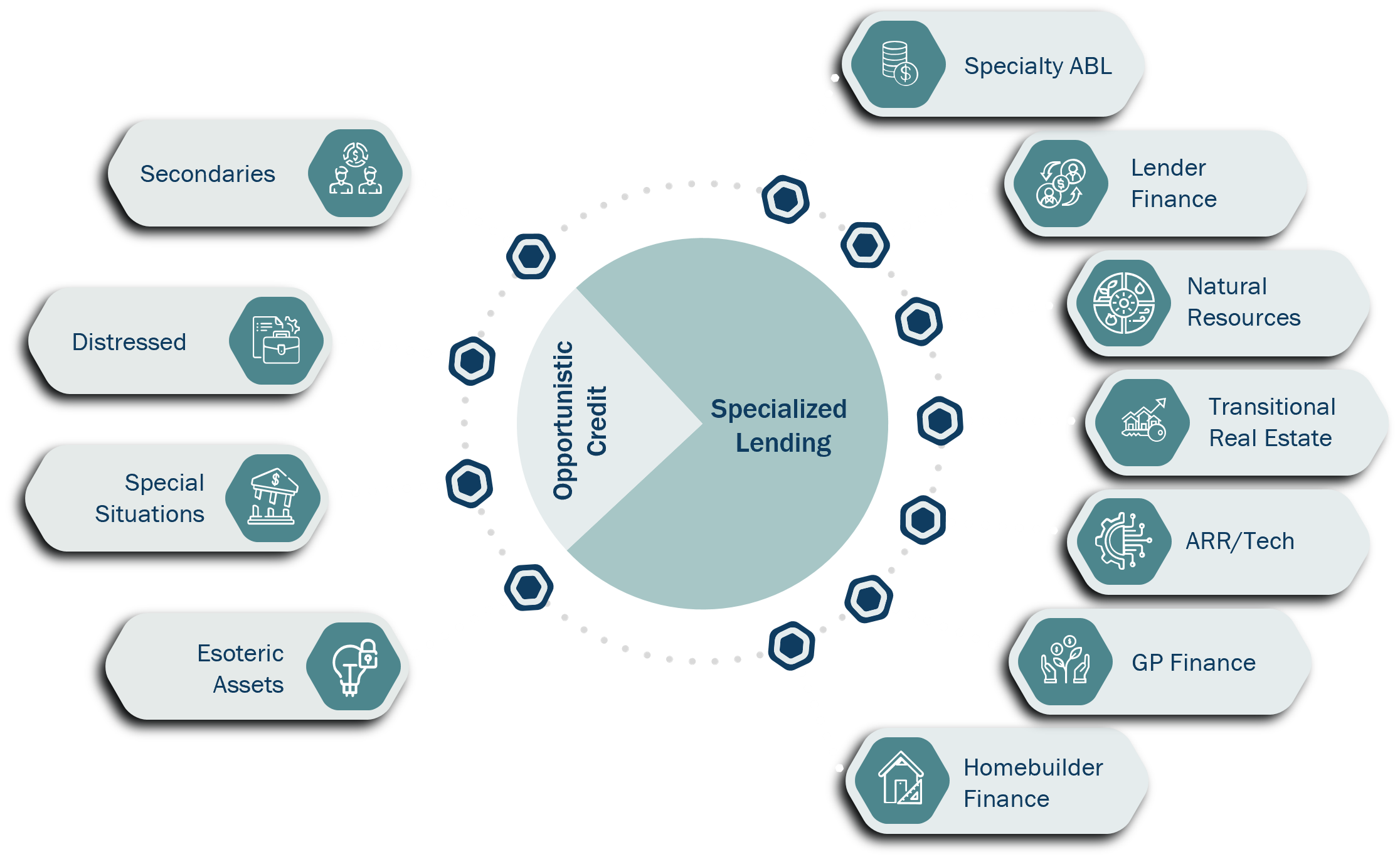

Our private credit strategy seeks to outperform traditional direct lending by focusing on specialty lending and opportunistic credit.

- Specialized Lending: We prioritize investments backed by valuable collateral. Our lending centers around core themes that exhibit quality collateral, high contractual returns, and strong lender protections.

- Opportunistic Credit: We complement our primary lending with investments in secondaries, special situations, junior capital and esoteric assets that offer equity-like return profiles.

20

Years investing in private credit

500+

Opportunities reviewed by the team in the past year

$2.5B

Invested and current mandates

Our Focus Areas

Seeking Capital?

Are you operating within a differentiated credit arena? We foster collaborative relationships with those who are executing well in sectors not favored by the broader markets.

Meet the Private Credit Team

Deputy Chief Investment Officer

Head of Private Credit

Managing Director

Vice President

Senior Analyst

Analyst

Associate